These are investments we are enthusiastic about.

The companies we are interested in operate in stable markets, have promising market positions, and are run profitably. Our three Novum Capital funds have 300 million euros of assets under management. We use these funds to implement succession plans, carve-outs, majority holdings, minority holdings – and above all to achieve growth and the best possible crisis resilience. We also manage complex investment scenarios in the best interests of the company.

-

Other cars have nice seats, too

Motors.co.uk is one of the leading online platforms for used cars, helping British car dealers reach millions of prospective buyers with 6,000 registered car dealers and almost 400,000 listings.

Novum Capital acquired the classifieds portal in November 2021 together with New York-based investment firm O3 Industries. The seller in the carve-out transaction was Adevinta, an international online marketplace specialist. With the divestment of the online platforms, Adevinta fulfilled an agreement with the UK Competition and Markets Authority as part of its acquisition of the eBay Classifieds Group, which includes the German classifieds sites Kleinanzeigen and mobile.de.

IndustryE-CommerceInvestedSince 2021SituationCarve-out from publicly listed corporationSales60 million euros (2022)Employees181 (2022) -

Where millions of sellers can find equally as many buyers

Gumtree is one of the leading classifieds portals in the UK. It brings together millions of buyers and sellers and facilitates thousands of successful transactions every day.

Novum Capital acquired the classifieds portal in November 2021 together with New York-based investment firm O3 Industries. The seller in the carve-out transaction was Adevinta, an international online marketplace specialist. With the divestment of the online platforms, Adevinta fulfilled an agreement with the UK Competition and Markets Authority as part of its acquisition of the eBay Classifieds Group, which includes the German classifieds sites Kleinanzeigen and mobile.de.

IndustryE-commerceInvestedSince 2021SituationCarve-out from publicly listed corporationSales29 million euros (2022)Employees110 (2022) -

Where Oscar winners go to make great films

Founded in 1991, MMC Studios operates one of Europe’s largest and most modern film and TV studio facilities, the “Coloneum” in Cologne-Ossendorf. MMC Studios is Germany’s leading full-service provider for TV shows, TV series, and motion pictures. In addition, the studio site is regularly used for corporate events, trade fairs, eSports and gaming events. MMC Studios also offers its complete range of services off-premises.

In 2019, Novum Capital acquired both MMC and Crosscast, an outside broadcasting and eSports specialist, and merged the two companies. Novum Capital was able to acquire MMC Studios in a swift auction process under the exact terms set out in the initial letter of intent.

IndustryEntertainmentInvestedSince 2019SituationAcquired from a private equity fund at auctionSales50 million euros (2023)Employees150 (2023) -

Because sweet delights are always tasty

Founded in 1956, the Schluckwerder Group is the leading manufacturer of marzipan, nougat, and chocolate specialities for the German retail industry. Rich in tradition, Lübeck-based marzipan manufacturer Erasmi & Carstens from 1845 also belongs to the group. Schluckwerder’s products are part of the core assortment in retail chains such as Lidl, Aldi, Penny, and Netto. The company has more than 550 employees and sells its confectionery products in 44 countries. Its production facilities are located in the North German towns of Adendorf and Lübeck.

Concurrently with the closing of the transaction, Novum Capital appointed a new management team, consisting of CEO, COO, and CFO. This allowed former shareholder Rolf Schluckwerder to retire, as was his wish.

In January 2021, Novum Capital sold the Schluckwerder Group to Dublin, Ireland-based food business Valeo Foods, which owns over 80 food brands, particularly in the snacks, sweets, and confectionery categories. Valeo Foods has an annual turnover of 1.2 billion euros (2020) and employs around 4 500 people across 20 manufacturing sites.

IndustryConfectioneryInvested2018 to 2021SituationSuccession planningSales106 million euros (2021)Employees551 (2021) -

Where waste slag is suddenly worth its weight in gold

Founded in 1969, C.C. Umwelt is one of the leading full-service providers for the disposal and recycling of incineration waste. Its very stable core business consists of the disposal, reprocessing, and recycling of waste incineration slags, the disposal of flue gas cleaning mass (filter dust) from waste incineration plants, and the processing and disposal of special mineral waste. C.C. Umwelt is based in Krefeld and operates further sites in Hagen, Würzburg, Schwandorf, Bleicherode/Sollstedt, Hamm, and Menteroda. The company is the only German filter dust disposal company with proprietary access to a backfill mine, where it can store waste in a way that is environmentally safe in the long-term.

By recovering approximately 70 000 tonnes of metal annually (including iron, aluminium, copper, gold, and silver) from the processing of slags and mineral wastes C.C. Umwelt reduces greenhouse gas emissions by about half a million tonnes per year compared to metal production from primary raw material sources. In addition, the reuse of approximately 950 000 tonnes of C.C. Umwelt’s materials as secondary construction materials reduces the annual mining volume of mineral raw materials such as gravel or sand and lowers landfill consumption accordingly.

Novum Capital has performed a legal and organisational realignment of the C.C. Umwelt group of companies, modernised its technology, and refocused the company on its core business. In February 2021, Novum Capital sold C.C. Umwelt to Blue Phoenix Group, which, with this acquisition, will have over 500 employees and will be a leading pan-European player in Germany, the UK, and the Netherlands.

IndustryIncinerator bottom ash treatmentInvested2017 to 2021SituationAcquisition from six foundationsSales82 million euros (2021)Employees121 (2021) -

Because protecting the environment is a lasting trend

Founded in 1986, VulkaTec Riebensahm is Germany’s leading manufacturer of volcanic planting substrates (e.g. for roof greening and tree rehabilitation) as well as volcanic industrial raw material products (e.g. filtration of drinking water and wastewater, noise protection, and surface treatment). Based in Kretz/Andernach, the company operates a further six sites in Germany as well as five locations in neighbouring countries.

Novum Capital paved the way for an effective succession plan for shareholder Dirk Riebensahm and helped the company to achieve a profitable 50 percent growth in revenues and workforce during the investment period.

In March 2020, Novum Capital sold VulkaTec to family-run business Bauder. With 1 200 employees and annual sales of 732 million euros (2020), Bauder is Germany’s leading manufacturer of flat-roof systems.

-

Where skin is successfully treated

The PsoriSol dermatology clinic in Hersbruck near Nuremberg is the largest acute-care, inpatient dermatology clinic in Germany, and one of the top-performing dermatology clinics in Europe. The clinic was included in the official hospital plan of the Free State of Bavaria in 2008, has 150 beds, and treats more than 4 000 inpatients per year. Treatments focus on inflammatory skin diseases such as psoriasis, neurodermatitis, and tumours.

As a hospital included in the Bavarian hospital plan in accordance with Section 108 of Book V of the German Code of Social Law (Sozialgesetzbuch), PsoriSol is authorised to set up ambulatory healthcare centres (Medizinische Versorgungszentren).

IndustryHealthcareInvested2018 to 2019SituationSuccession planningSales13 million euros (2019)Employees140 (2019) -

Because good food needs great packaging

Founded in 1966, ES-Plastic produces food packaging such as trays, lids, cups, sorting inserts, and foils – primarily for ready meals and fresh meat. ES-Plastic is the market leader in polypropylene trays for use in modified atmosphere packaging (MAP). The MAP system extends the shelf life of packaged food products.

Novum Capital restructured the company after the takeover and regained the trust of customers such as Tönnies, Wiesenhof, Kaufland, and Edeka. Thus, ES-Plastic became fit for the future again. The company now belongs to the French Proplast Packaging Group, which was able to improve its competitive position in Europe through the acquisition of ES-Plastic.

IndustryFood packagingInvested2012 to 2014SituationCarve-out from insolvent Swiss corporationSales41 million euros (2014)Employees241 (2014) -

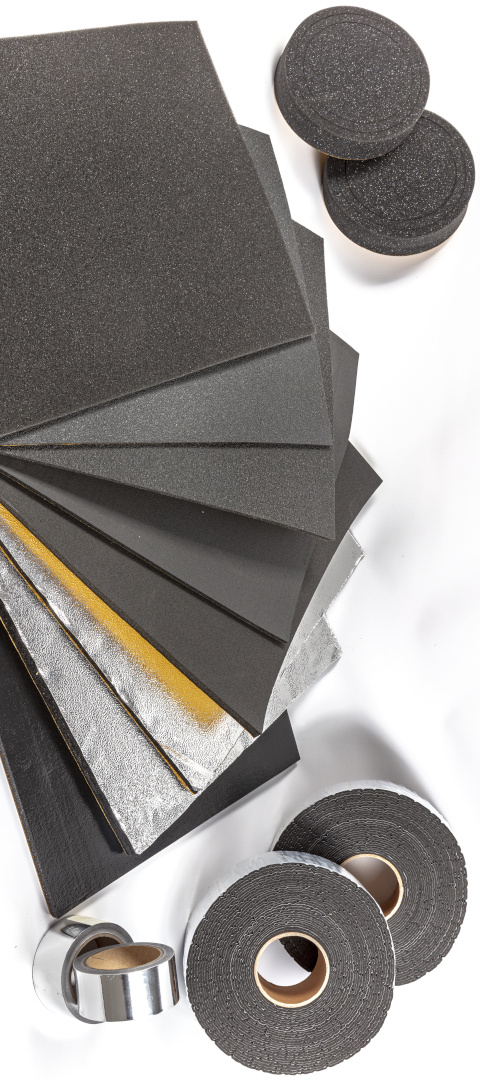

Silently successful in loud areas

FAIST ChemTec produces anti-drumming sheets for the attenuation of loud noises. Among others, they are installed in cars, machines, or household appliances (“white goods”). FAIST ChemTec has manufacturing sites in Germany, Poland, Spain, and the USA. The company's European market share at the time of acquisition in 2010 was 60 percent.

The acquired business division previously belonged to automotive supplier AKsys, which was in bankruptcy at the time of the transaction. However, the anti-drumming division was highly profitable and suitable for independent development. Novum Capital enabled entrepreneur Michael Faist together with a co-investor, private equity company Hannover Finanz, to spin off the anti-drumming division into an independent company and successfully reposition it. The purchase was completed in record time and the company subsequently developed very successfully. Today, FAIST ChemTec is part of the Swiss building materials group Sika, which manufactures construction chemicals such as sealants and adhesives.

IndustryAutomotive, household appliancesInvested2010 to 2012SituationCarve-out from insolvent corporationSales139 million euros (2012)Employees731 (2012)